Trustee vs Beneficiary – Whats The Difference

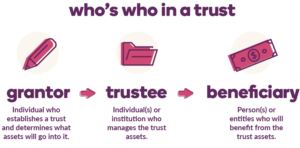

A trust creates a separate legal entity that holds some or all of an estate’s assets. A grantor develops the trust and supplies the assets to distribute them to a person or organization at a later time. The recipient is known as the beneficiary. Beneficiaries can be either individuals or organizations, like a school or charity. The person or organization responsible for managing the trust and distributing assets according to its terms is known as the trustee. The grantor selects both the trustees and beneficiaries. A Carmel Indiana lawyer can advise you during the process of designing a trust and choosing trustees.

Trustee Responsibilities

Fiduciary duties bind the trustee to act in the best interests of the beneficiary while following the rules set forth within the trust. A trustee’s responsibilities encompass preparing and filing the necessary paperwork with a court or other government agency when transferring ownership of trust assets to a beneficiary. Trustees often manage investments and other duties necessary for the maintenance of the assets. They have to keep thorough financial records about the status of the trust.

A trustee’s records provide proof of compliance with the terms of the trust. At times, disputes arise between trustees and beneficiaries. Careful record keeping can prepare a trustee to defend the trust from unhappy beneficiaries. These conflicts typically result from trust terms that limit distributions or impose requirements upon beneficiaries before they can receive funds.

Selecting a trustee for your trust is a critical decision. Some people choose professional trustees at financial institutions who have the training to manage investments and maintain proper records. Alternatively, you have the option of assigning the position to any trustworthy individual capable of the task.

Beneficiary Rights

In general, beneficiaries receive distributions from trusts as long as they qualify according to the terms of a trust. They sometimes need to supply records that they received distributions so that the trustee can mark the transactions as complete.

When beneficiaries suspect that trustees are mismanaging assets or not following the terms of the trust, they can petition a court to remove the trustee. Because beneficiaries generally have little power over the operation of a trust, they must provide evidence of mismanagement to succeed in court against a trustee. The representation of a Carmel Indiana attorney help beneficiaries understand their legal positions and prepare for court appearances.

At Webster & Garino, you can discuss your concerns and goals with a Carmel Indiana estate planning lawyer knowledgeable about trust and estate law. Contact us today with any of your estate planning questions.

Read more on: Will Webster breaks down the Seo vs State of Indiana